Measuring Travel Behavior Demographics at Walt Disney World

Jump Ahead

Walt Disney World is one of the most popular theme parks in the U.S. and every child’s dreamland. Many individuals come from around the world to view the characters, taste the food, and enjoy the rides. This amusement park creates an indescribable feeling of excitement and anticipation.

It’s a place I’ve always wanted to visit, and I know that I will someday. In the meantime, I’m satisfying my curiosity about Disney World by using StreetLight InSight (R) to explore the audience that goes there. However, I also think my analysis can add value for city and urban planners who want to:

- Understand the types of people large amusement parks attract.

- Understand the volume of hotels and accommodations you would need to provide for an amusement park of Disney World’s scale.

It’s important to note that this type of analysis could be used for economic development related to any attraction or special activity area – not just Disney World and theme parks. Some examples are:

- Monuments (i.e. Statue of Liberty)

- Museums (i.e. Virginia Fine Art Museum)

- Parks (i.e. Yellowstone National Park)

- Beaches (i.e. South Beach)

Methodology

As a marketing intern for StreetLight Data, I used StreetLight InSight to run an analysis on Walt Disney World. My research used Big Data to reveal important, hard-to-find insights about Disney World’s audience. For example, the study provides detailed information on where trips to Disney World usually begin, the aggregate home locations of visitors, and visitors’ demographic profiles.

My first step was to create the zones (Fig. 1) to run an analysis on Disney World. The platform allowed me to run several types of analyses that gave me the information I needed to understand who goes to Disney World. The analyses I performed are:

- Origin-Destination to Preset Geography (ODG), used to analyze travel patterns from my zone sets with a standard geography: ZIP codes, TAZs, or census block groups.

- Zone Activity Analysis (ZAA), used to analyze all travel activity in a zone set, regardless of origins or destinations.

- Visitor Home and Work Analysis (VHW), used to analyze the home and work locations of visitors to a zone or zone set by grid or census block group. Demographics are also available.

The platform also allowed me to study who is visiting the park using different data sources. The data sources I used for this study include:

- Location-Based Service Data, which is created by smartphone apps that use location-based services. It offers high spatial precision and a large sample size.

- U.S. Census Data, which comes from demographic surveys that are conducted every 10 years by the US government.

The LBS data in this study comes from smartphones owned by adults in the U.S. that were running location-based services apps in the Disney World Park from June through August 2017.

Demographics: Family Status

First, I decided to look at the demographics of Disney World visitors. I did this with the Visitor Home-Work analysis. The analysis gave me insights on the race, income levels, and family status of individuals who attend Disney World by combining LBS and Census data. These data are analyzed anonymously, in aggregate. They describe the groups of people who visit Disney World, not individuals. (Note: StreetLight InSight does not use LBS data from children.)

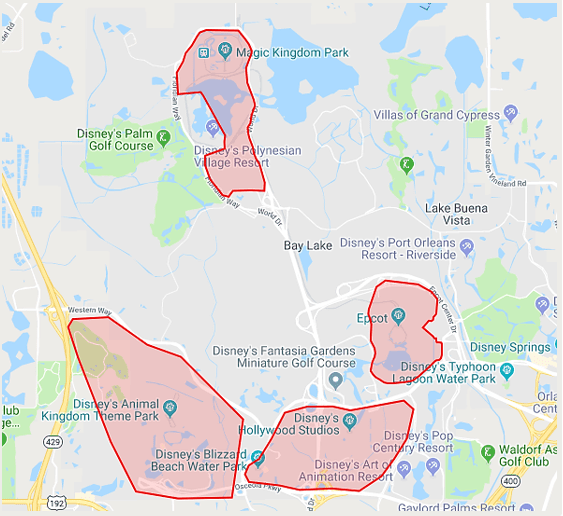

In most commercials that advertise this dreamland, there are a diverse group of people at the amusement park and most of the individuals are young adults and/or children. Those advertisements display many families having a great deal of fun at Disney World. This is the image Disney uses to advertise their park as a family destination. However, according to Fig. 2, most people that visit the park do not have kids in their household. In fact, the research only shows 36.7% of the guests reside in a household with children under age 18. This is a surprising finding. Here are some reasons this may be the case:

- Adult workers are most likely included in the results – they are likely to have smartphone apps with location-based services apps with them when they arrive for work.

- The park has some attractions that appeal to adults and many corporate conferences are hosted in the park during weekdays

- International visitors who come with family are not included in the study.

- Some kids do not visit with relatives or adults they live with.

- Some kids who visit the park may live with guardians or foster homes that are not accounted for in the US census.

Disney World captivates an audience of all ages. This is one of the reasons why Disney World is one of the best destinations for friends and family. This also goes to show that Disney’s marketing strategy successfully targets more than one age group.

Demographics: Race

There is no doubt that many people from different ethnic backgrounds and cultures go to the theme park, but there were fewer minority visitors than I expected. The graph below visualizes a large amount of white individuals.

Within the graph there is also a small streak of blue; which indicates that the smallest minority in the park are Pacific Islanders. This is somewhat understandable considering Pacific Islanders makeup 0.2% of the U.S. population. Nonetheless, there are still a few Pacific Islanders making the journey to visit the famous park.

After Caucasians, Black/African Americans are the second largest group in the Disney World. I find this to be interesting because I had expected Hispanics to be the second most represented race in Disney World. According to the Census Bureau, they are the second largest race in Florida and the U.S., while Black/African American are the third most represented race in North America.

Demographics: Income

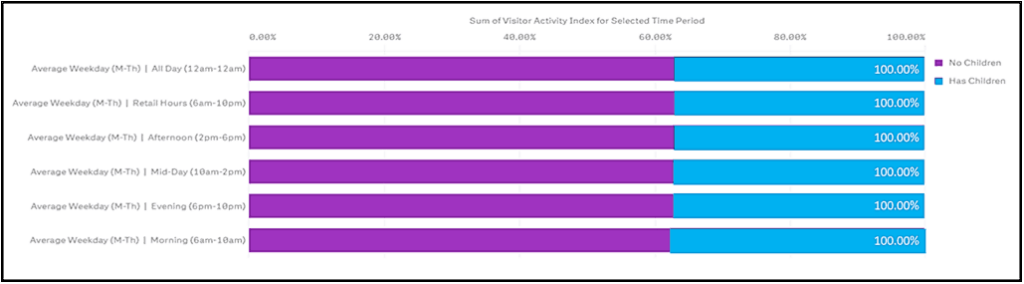

Disney World has heavy congestion throughout the park and sometimes that causes the wait for rides to be extremely long. According to Fox News, Disney increased prices to reduce long lines for rides and improve the flow of traffic in the park. The new prices seem to be affordable for households who have an annual income of $35,000-50,000 because they are the most represented income level in the park.

Nonetheless, there are still many people from lower income levels that visit the park. About 42.1% earn less than $35,000 to be exact. It’s interesting to see in Fig. 4 that households who have an annual income of $125,000 or more (the second largest income group in the US), don’t visit the park as frequently, although they have the funds.

Origins and Destinations

A very popular Canadian musician named Drake once said, “Sometimes it’s the journey that teaches you a lot about your destination.” This quote emphasizes that you can learn a lot about your destinations through your origins. This brings me to the second analysis type I used: Origin-Destination to Preset Geography (ODG).

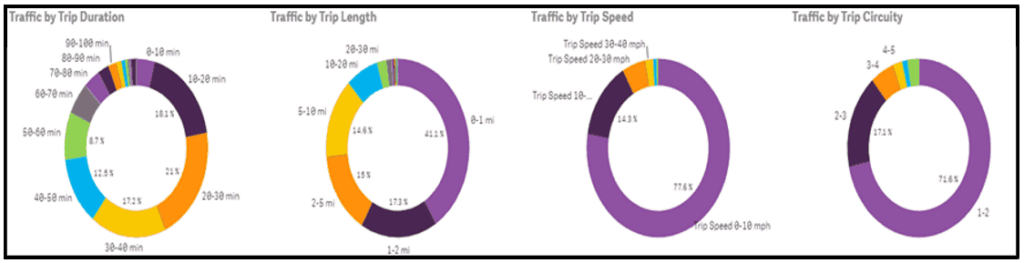

Figure 5 indicates that 41.1% of trips to Disney World are less than one mile long. This emphasizes that most people who come to Disney World begin their trips within walking distance of the park.

Did you know the average person walks three miles per hour? That’s about twenty minutes per mile. A few examples of the places that people visit Disney World from are: Walt Disney World Resort, California Grill, Oasis Canteen, SeaWorld, and other places that are nearby.

Home and Work Locations

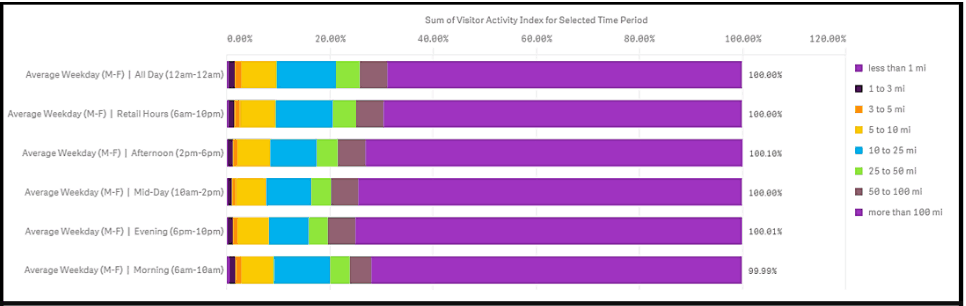

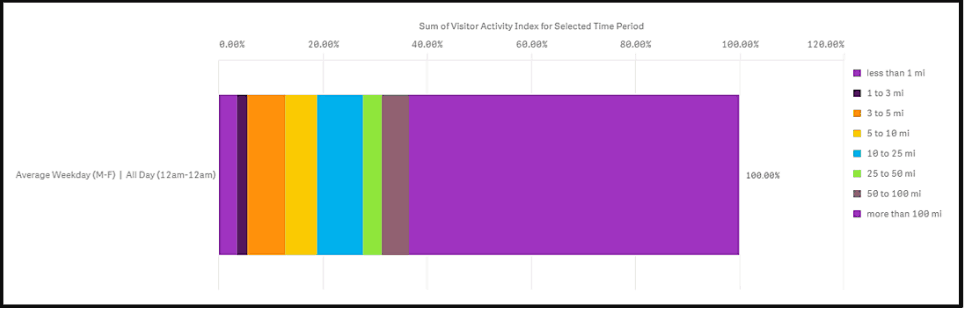

Lastly, I analyzed the visitors’ home and work locations. Most visitors’ homes are located as far as 100 miles away from the park. About 72.43% to be exact. Figure 6 shows only 0.50% of visitors live less than a mile from the park. According to Fig. 7 most visitors’ workplaces are also located at least 100 miles away from Disney World. I expected this to be the outcome since majority of the visitors’ homes were located more than 100 miles away too.

Conclusion

Although summer may be the busiest time of the year, it is also the best time to go Disney World. As songwriter Brian Wilson once said, “Summer means happy times and good sunshine. It means going to the beach, going to Disneyland, having fun.” If you swap “Disneyland” for “Disney World,” I totally agree with his statement. What better way to accomplish all these goals than going to Disney World? Next year, when the children are on summer break, plan a fun vacation with the family to the magical land of Disney World!

Resources

https://www.census.gov/quickfacts/fact/table/US/PST045217

https://disneyworld.disney.go.com/

This blog article was written by an Antonia Cheatham, a StreetLight Data summer intern.

Ready to dive deeper and join the conversation?

Explore the resources listed above and don’t hesitate to reach out if you have any questions. We’re committed to fostering a collaborative community of transportation professionals dedicated to building a better future for our cities and communities.