As Freight Activity Rises, Trucking Analytics Help Planners Keep Up

A StreetLight analysis shows overall truck activity has risen annually at six major retail fulfillment centers across the U.S. To keep up with increased truck activity, access to comprehensive, validated truck input is critical.

Trucks have a significant impact on roadway conditions, and that impact is becoming even more pronounced as warehouses open near residential areas. This puts the onus on transportation planners to closely monitor trucking activity to understand road stress, air quality conditions, safety concerns, and more.

But actually being able to quantify truck movement is challenging and typically relies on rudimentary estimates based on old truck data, as well as difficulty assessing truck cut-through routes, and poorly maintained truck route maps. There’s also a high cost associated with manual truck data collection.

StreetLight’s newly introduced Truck Volume Metrics allow planners and commercial freight operators to overcome this challenge by offering access to truck counts for any road, any season, segmented by vehicle class (light-, medium-, heavy-duty).

Managing trucking activity is critical for state DOTs setting and reporting on freight performance targets, as well as MPOs that must manage freight plans. Cities also need to make sure local roads are safe for residents and manage freight emissions, especially around heavy truck utilization corridors like warehouses and ports. Even commercial operators need to be able to identify more efficient routes for trucks to optimize freight operations and forecast revenue.

Using StreetLight’s Truck Analytics To Study Warehouse Traffic Trends

To understand how truck activity has trended over the last few years, the StreetLight team used Truck Volume Metrics to analyze 6 different retail distribution centers around the country. We chose popular distribution center locations like Walmart (Arizona), Best Buy (NJ), Amazon (Mt Juliet, TN), among others.

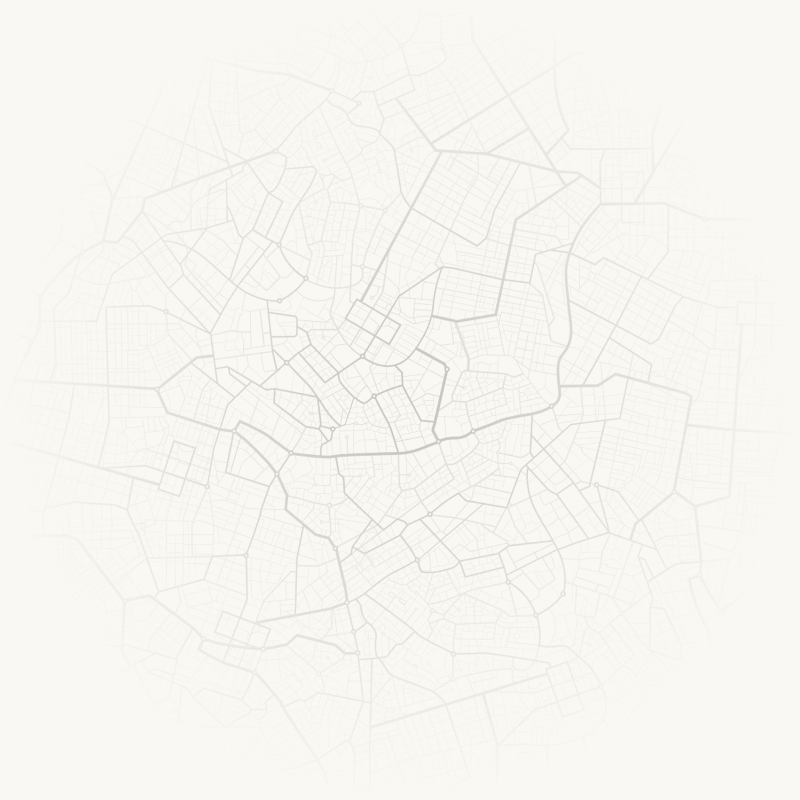

Locations of distribution entrances where StreetLight ran analyses to study truck movements for years 2019, 2020, and 2021.

The analysis looked specifically at average all day weekday trips.

Average daily Truck Volume by year across 6 different major U.S. retail warehouses.

As the above chart shows, average truck activity has gone up annually in each of the past 3 years. We see a 7% increase in retail distribution truck activity in 2020, and a 3% increase in 2021.¹ While retail sales increased dramatically in 2021, the slower growth in truck activity may reflect driver shortages² during the year as well as new warehouse openings.

To better understand truck activity at a specific warehouse location, we ran a month over month analysis for 2019-2021 to understand heavy-duty trucking activity near a separate Amazon fulfillment center in San Bernardino, CA.

Amazon fulfillment center in San Bernardino, California

The Inland Empire in California has seen a rise in warehouse operations in the past few years, which has caused some tension, as the job growth that comes with expanded operations is balanced against potentially worsening air quality and traffic congestion.³

Average daily heavy-duty truck volumes by month at San Bernardino fulfillment center entrance/exit.

Looking at average weekday volumes for heavy-duty trucks (14,000 lbs or more) at the entrance/exit of the San Bernardino center, Amazon’s e-commerce sales spike in 2020 is reflected in the trendline. Truck activity shows major upticks in February, likely as pandemic stockpiling began in earnest, and then again in July and September.

Overall, 2020 was an extremely spiky year in terms of truck activity at the San Bernardino warehouse. By comparison, 2019 and 2021 saw less dramatic fluctuation in trucking activity.

Using Truck Volume to measure congestion and multimodal safety planning

As new warehouses open near residential communities, planners will need to pay close attention to overall trucking activity, especially among heavy-duty vehicles, which can impact air quality, roadway conditions, and safety. They will also want to monitor routing to help ensure trucks are using corridors with the least impact on residents.

To quickly identify congestion bottlenecks on major freight corridors, StreetLight’s Truck Volume can be combined with other congestion Metrics available within the platform like speed, travel time, vehicle hours of delay (VHD), and vehicle miles traveled (VMT).

Further, the platform can be used to measure the share of personal vehicles and commercial truck activity around heavy traffic areas like ports, highways, and industrial zones, as well as to estimate roadway vehicular traffic by weight class to create safe corridors for personal and commercial vehicles.

How StreetLight validates its U.S. Truck Volume Metrics

StreetLight’s Truck Volume Metrics have undergone robust data validation, including validation against temporary and permanent counters and other industry standards. The platform’s vehicle classifications by weight comply with FHWA and HCM (Highway Capacity Manual) vehicle classification categories.

To learn more about how StreetLight develops and validates its Truck Volume Metrics, access the white paper here.

1. Statista, Total retail sales in the United States from 1992 to 2021. Aug 24, 2022.

2. Transport Topics, Driver Shortage Defines Trucking for 2021. December 17, 2021.

3. Lee, Kurtis. The New York Times, As Warehouses Multiply, Some Cities Say: Enough. Oct 10, 2022.