City Traffic Congestion Is Coming Back – But Not Like Before

The pandemic led to lower traffic congestion rates across the U.S., but for many major cities, congestion is now making a comeback.

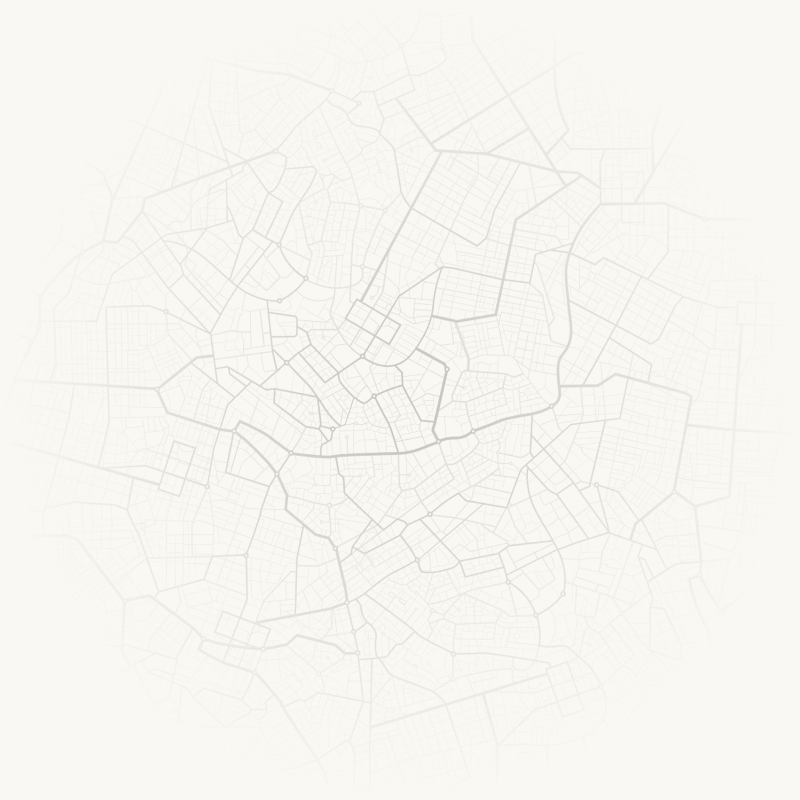

In our latest Congestion Report, we analyze the top ten U.S. cities to understand how traffic congestion is trending and what transportation experts can do to ensure cities thrive.

Why is diagnosing city traffic congestion so important right now? While returning traffic could mean a boost to the economy, especially for downtown business districts, it also means increased emissions and lower quality of life for those traveling in congested corridors.

The shifting transportation needs during the pandemic, including the temporary reprieve in congestion, has allowed many cities to experiment with traffic calming and active transportation projects like slow streets and added bike lanes; projects like these could prove useful in managing congestion in the long term. At the same time, it’s important to understand how cities’ transportation infrastructure can support downtown commerce without relying on nine-to-five culture.

Rush hour traffic is changing

Although pandemic-related workplace restrictions have been largely lifted across the U.S., many workers who once commuted into downtown for nine-to-five jobs are still working remotely.

Those who are traveling downtown by car are doing so later in the day, our analyses suggest. Downtown congestion is returning to pre-pandemic levels fastest during the midday hours, while morning rush hour has been the slowest to return.

While 2022 congestion is still below 2019 baselines in the top 10 U.S. downtowns, it’s making a comeback, especially between 10 a.m. and 3 p.m.

On average, downtown traffic congestion — as measured by Vehicle Hours of Delay (VHD) — is approximately 40% below April 2019 levels during peak a.m. hours across the top 10 U.S. downtowns, but only 22% lower during midday hours.

Long commutes are more of a barrier than before

In addition to an overall reduction in downtown traffic, breaking out the sources of this traffic by commute distance reveals that travelers are less likely to bother with a long commute into downtown than they were before the pandemic, according to analyses of Lower Manhattan and Downtown Houston.

Lower Manhattan traffic originating from over 50 miles away saw the biggest dip compared to pre-pandemic traffic volumes when it comes to the peak a.m. weekday hours.

In Downtown Houston, a.m. traffic originating between 10 and 50 miles away dropped by over 30% while those with the farthest to travel made 26% fewer trips compared to April 2019.

With each of these downtown districts dominated by offices, it’s unsurprising to find that the pandemic caused a drop in traffic volume during the usual morning rush hour window. What’s notable is that this dip is especially pronounced among those with the farthest to travel.

In other words, there is a trade-off happening: For those with more manageable distances to travel, the pull of downtown is strongest. But for those coming from much farther away, downtown office culture holds the least sway.

How city experts can help downtowns thrive

With these new insights, one lesson is clear: If cities want to spark economic activity, they will need to think beyond nine-to-five culture.

Mitigating the congestion that historically kept some out of the city must play a part in revitalizing these downtowns and making them more attractive to recreational visitors and residents seeking to be in the city not for the nearness of work but for the quality of life.

A data-informed approach is essential for identifying strategies that will mitigate congestion. For example, cities that implemented COVID-era experiments with slow streets, widened sidewalks, and temporary bike lanes, among other projects, have a unique opportunity to measure the impact of these projects on congestion and other traffic woes that could dissuade travelers from visiting downtown economic centers.

Leaning into downtown destinations as cultural capitals also shows significant promise. For example, while the number of workers in offices is still below pre-COVID levels, the percentage attending popular entertainment such as NBA games or making restaurant reservations is now nearing parity with pre-COVID behavior, according to Richard Florida, co-founder of CityLab and author of The New Urban Crisis.

To see the full breakdown of which cities are seeing congestion return fastest and what cities can do to address traffic while ensuring downtown economies thrive, check out the full report.