The Deadline to Submit EV Plans (and Get NEVI Funding for Your State) Is Almost Here. Got the Mobility Data You Need?

Huge changes are about to occur in our electric vehicle infrastructure. More than 7.5 billion federal dollars are heading to the states, beginning with funds to expand our nationwide network of EV chargers ten-fold. With important funding deadlines coming up soon, states need to move fast. First order of business? State DOTs must closely examine the mobility landscape to identify and build a map of optimal EV charging locations in their regions.

Get Your AFC Nomination Reports and NEVI Deployment Plans Finished On Time

States will be apportioned infrastructure dollars through the newly-formed National Electric Vehicle Infrastructure (NEVI) Formula. To be considered for funds, states must designate Alternative Fuel Corridors (AFCs), highway segments with the current or planned infrastructure to support fully electric private and commercial vehicles. The NEVI formula also requires that AFCs take rural areas, air quality improvement, and access for disadvantaged communities into consideration.

Two important dates should be on your calendar.

- May 13: Deadline for designating Alternative Fuel Corridors (AFCs)

- August 1: Submission deadline for EV Infrastructure Deployment Plans to the Joint Office of Energy and Transportation

Mobility Analytics Help Answer Four Key Questions For Optimal EV Charging Site Evaluation

Even if your state has a solid EV charging network today, you’ll need to investigate whether your existing corridors are sufficient—and if they aren’t, identify where infrastructure gaps lie. Start with these four questions:

1) What is the existing traffic demand?

Your first step is to identify the current traffic demand at various locations. You can use Metrics from the StreetLight platform to understand vehicle volumes (for all vehicles, not just EVs) at these locations and pinpoint trip activity hotspots. You can also evaluate highway exits in your state to determine which exits have the highest traffic demand. These insights will help you decide which exits will provide accessible and reliable charging locations for long-distance trips. Existing traffic demand data will greatly help you evaluate AFCs for your NEVI funding proposal.

2) What are the aggregate demographic characteristics of existing drivers at these sites?

StreetLight InSight® combines traffic volume data with demographics such as education level and household income, analyzing where aggregate groups of people live, work, and shop. Beyond spotting activity hotspots, the data reveals the purpose behind drivers’ travel. This includes whether people are coming, say, from home to the shopping plaza or stopping there on the way home from work. These Metrics help determine the traveler profile at these potential or existing EV sites. This greatly aids in EV charger planning, because it shows the precise hotspots—like a mall or a theater, or an office park—where people purposely schedule activities to access public charging stations.

3) Where are vehicles coming from and going?

Origin-Destination Metrics and Top Routes are important pieces of the infrastructure puzzle. StreetLight InSight® will show you how far travelers have come to reach a popular destination, as well as the most frequently used roads and highway corridors. These insights will help planners determine where to build key nodes of a larger charging network or corridor. They also determine the types of chargers that might best serve travelers.

These Metrics are a great place to start when trying to determine where the traffic demand is along AFCs within a region.

4) How long are vehicles staying at certain sites?

To build a viable charging infrastructure, you must understand dwell times at destinations like shopping plazas, office buildings, movie theaters, and more. Once you know how far people travel to get to primary destinations, you’ll need to see how long they stick around. This information will help you predict charger use and the type of chargers that will best support travelers. For example, 30-minute DC fast chargers are needed outside of a grocery store or a movie theater. They’re pricey but absolutely necessary. On the other hand, Level 2 chargers—which are slower but less costly—would work well at longer dwell destinations like a hotels.

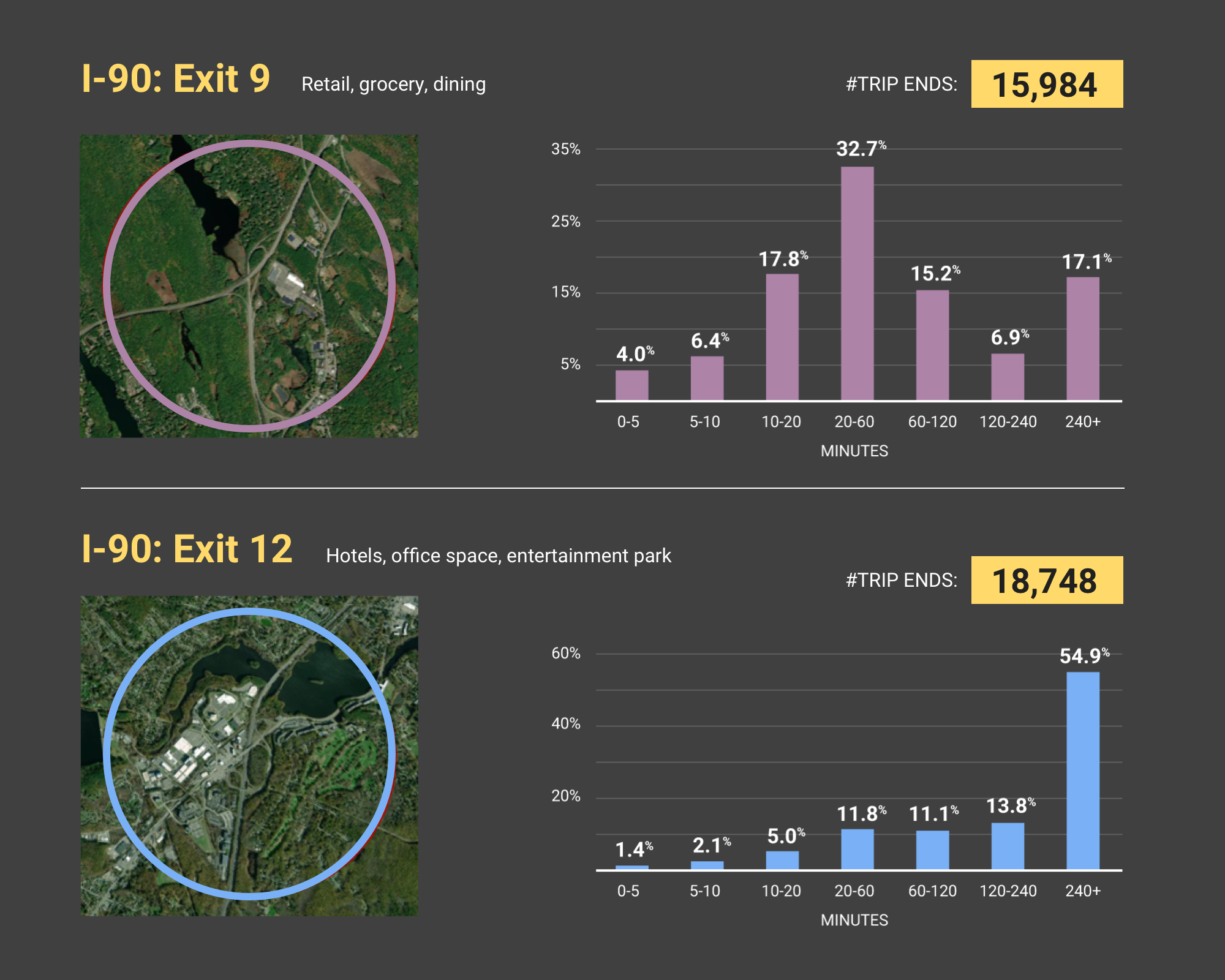

Two Interstate Exits Have Very Different Charger Needs

At two different Massachusetts Turnpike exits, the dwell time (the length of stay at a given location) varies tremendously. Exit 9, filled with shops, grocery stores, and restaurants, shows that vehicles are mostly parked for 20-60 minutes—enough time to grab a burger. Exit 12, with its hotels, offices, and entertainment park, generally keeps people lingering for more than four hours. Big difference.

Comparing dwell time of different exits on a highway corridor

These dwell time findings offer a great view into the type of chargers that would make sense for each exit. Investment in DC fast charging would be more appropriate for Exit 9, whereas Exit 12—which draws the longer stays—would be very well served by less expensive Level 2 or 3 chargers.

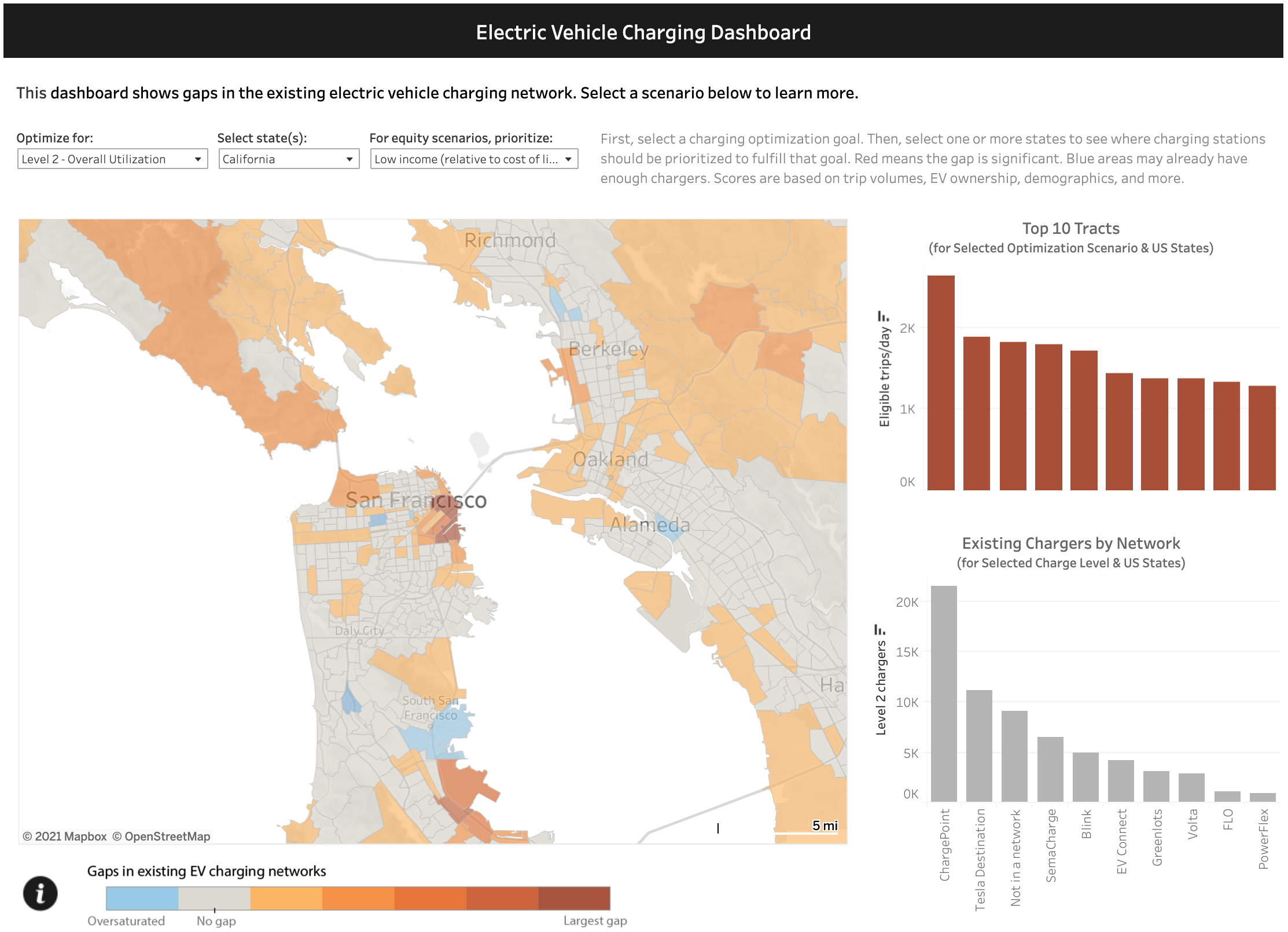

Looking to Attain Specific Policy Goals (Like Equity)?

StreetLight Data offers a regional scanning tool to identify specific charging gaps and provide insights into aspects such as utilization potential, trucking, and identifying prime locations. If you’ve already located key sites, but need data to support equity initiatives—like Justice40—layer on metrics to optimize for equity scenarios involving disadvantaged and low-income communities, as well as exposure to air pollution. Equity is a huge part of the future of EV infrastructure, so the sooner you gather the equity picture for your state, the better.

Drive Your Bid for Infrastructure Dollars

There are a limited number of dollars, and the stakes are high. Mobility metrics and demographic data can support your proposal for NEVI Program funds. StreetLight’s EV offerings will help you identify optimal charging sites along key corridors to serve your key priorities, grow EV adoption, and help shape our EV future as a nation.