Traffic Data Shows How the American Mall Is Being Reborn — On Black Friday and Beyond

After declining visitation and sales led many to declare the death of the American mall, these retail spaces are redefining themselves. Driving patterns show how Black Friday traffic and weekly mall-going behavior is changing, and how malls can adapt.

Jump Ahead

For at least a decade, people have been declaring the death of the American mall. After their heyday in the 80s and 90s, tens of thousands of malls have closed across the nation, leaving just over 1,000 today.

Many expected the pandemic to be the final nail in the coffin, as a rise in online shopping and mega-retailers like Walmart was already occasioning a wave of mall closures and declining sales. The once bustling weekend destinations were increasingly vacant, with fewer visitors and fewer storefronts.

But the malls that persist are redefining themselves through entertainment, housing, coworking, distribution, and more. And data from StreetLight shows that the work-from-home era is shifting how people visit the mall and when. These new visitation patterns carry implications for what Thanksgiving weekend and the Black Friday holiday look like at the mall, as well as during a more typical week, as the latest generation of shopping centers adapt to how people work, shop, and travel now.

How Mall Visitation Patterns Have Changed Over a Typical Week

Today’s malls are no strangers to change. Where once you might exclusively have found big box stores and fast casual food court dining, you might now discover arcades and activity spaces, gyms, specialty food markets, animal shelters, or an American Ninja Warrior Adventure Park.

In some cases, these reimagined malls are showing signs of growth. According to Insider Business,

Ahead of the 2022 holiday season, foot-traffic data indicated that shoppers were returning to malls for their holiday shopping and that the bulk of sales would happen in person. [1]

After the pandemic disrupted daily life and led to new routines, travel patterns, and relationships to public space, emerging mall traffic trends reveal how owners and retailers can begin to adapt to the post-pandemic reality.

To measure how the pandemic impacted mall-going behaviors, analysts at StreetLight looked at the distribution of trips ending at 13 of the top American malls between 2019 and 20222 and found notable changes in visitation patterns across different times of day and parts of the week (weekdays vs. weekends).

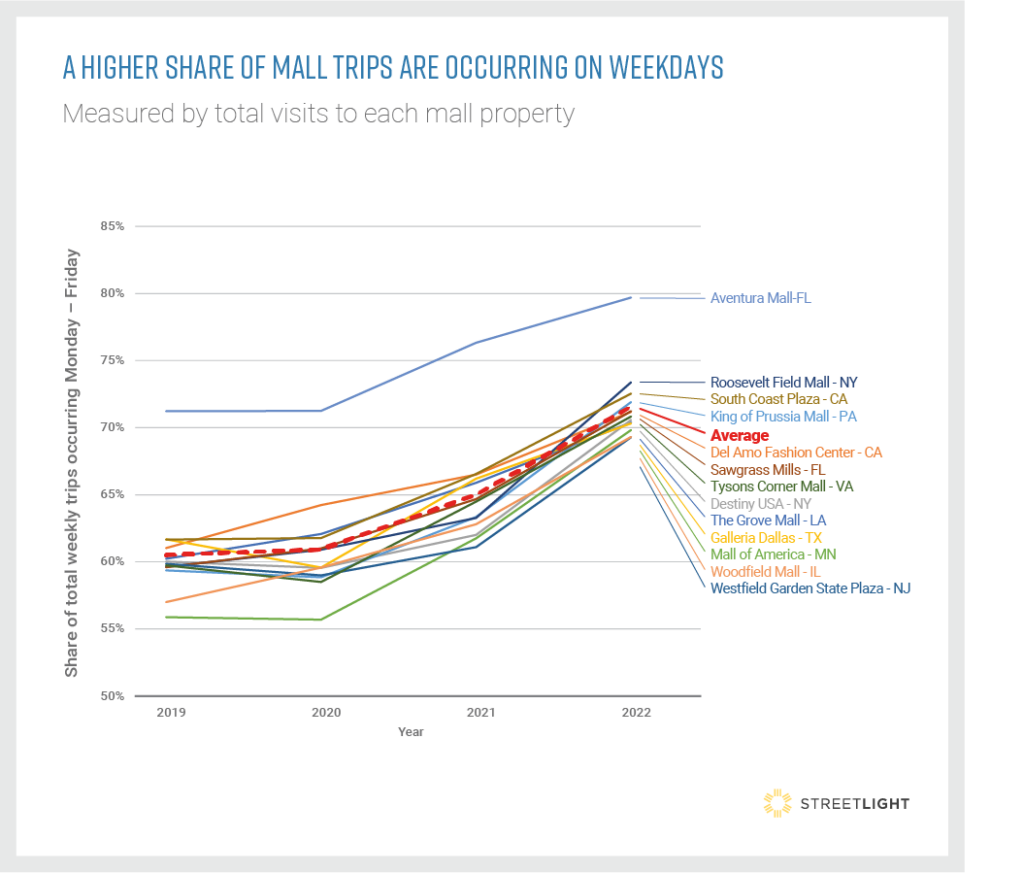

During their heyday, malls were a popular weekend destination. Time away from work and school offered opportunities to shop and socialize. 2019 trip data shows that about 60% of mall visits at these top malls occurred on weekdays on average.

Since then, the proportion of total trips occurring on weekdays has only risen with the onset of the COVID pandemic and a new “work-from-home” era. In 2022, over 70% of trips ending at the 13 malls analyzed were weekday trips.

The Mall of America in Minnesota saw the biggest change in distribution of trips towards weekdays, growing from around 56% in 2019 to roughly 70% in 2022. Roosevelt Field Mall in New York also saw a comparable shift from about 60 to 74%.

While the percentage of weekday trips dropped for some malls in 2020 — including Galleria Dallas in Texas, Tyson’s Corner in Virginia, and the King of Prussia Mall in Pennsylvania — by 2021, all 13 malls were seeing an upward trend in weekday trip share that would continue into 2022.

These new mall traffic patterns may suggest that working Americans have more flexible weekday schedules, making them more likely to visit the mall on weekdays than they once were.

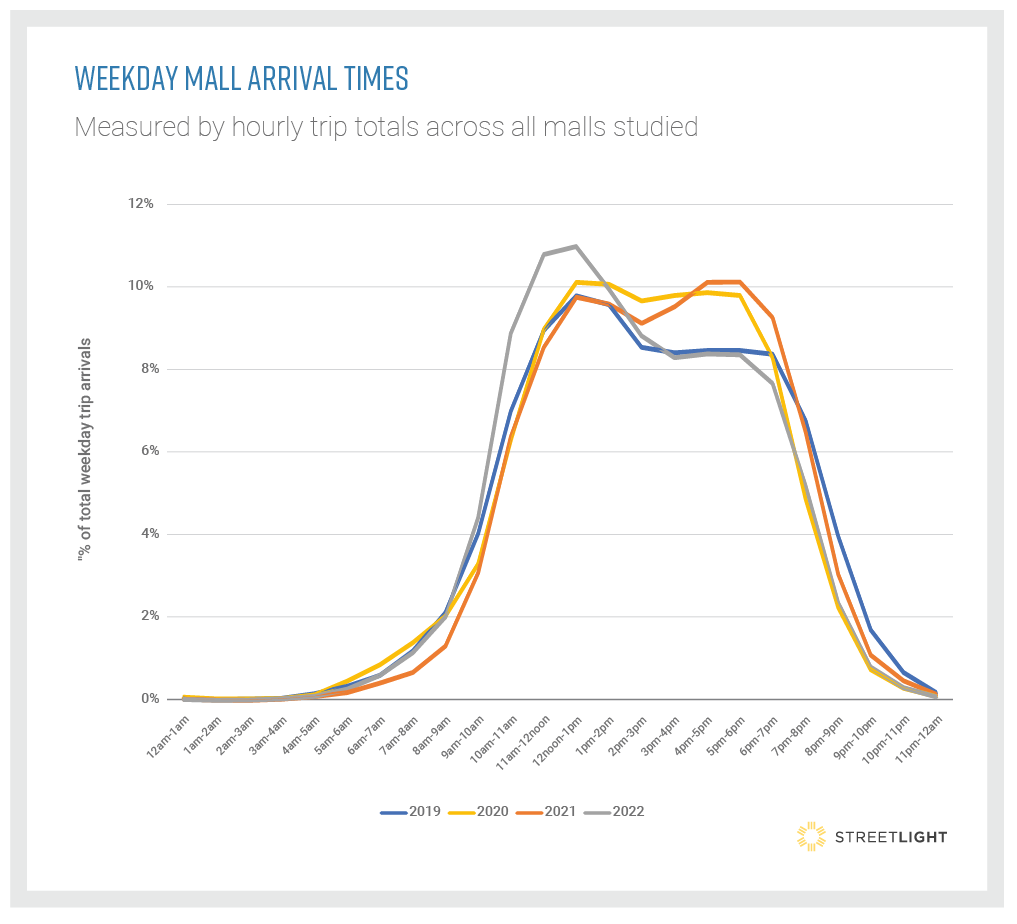

The time of day when most mallgoers arrive has also shifted. Before pandemic lockdowns, weekday mall traffic trends show most visitors arrived between noon and 1 p.m. Arrivals remain steady between 2 and 6 p.m., then drop off sharply in the evening starting at around 7 p.m. In other words, most mall visits occurred during the typical nine-to-five workday, especially over lunch hours or in the early afternoon.

Interestingly, arrival times have fluctuated considerably in the years since the pandemic began. In 2020, the peak arrival time was still between noon and 2 p.m., but hourly arrivals remained near peak all the way until 6 p.m. when they begin to drop off sharply. This evening drop-off begins about an hour earlier than it did in 2019.

In 2021, something surprising happened. While morning visits still peaked at noon and saw a short drop-off into the afternoon hours, a second, more pronounced peak occurred from 4 to 6 p.m. before the evening drop-off. This suggests that perhaps mallgoers preferred to use their afternoon hours to get shopping done or enjoy other mall activities.

By 2022, another significant shift had occurred. Bucking the new trend established in 2021, 2022 saw earlier mall arrivals on average, with higher percentages of visitors arriving between 9 a.m. and noon than any other year studied. However, mall traffic still peaked at noon as it had before the pandemic, and saw comparable percentages of afternoon arrivals before beginning an early drop-off around 6 p.m.

As some remote workers are returning to an office or hybrid work environment, this shift to earlier arrival times could signal increased desire to shop and use other mall amenities such as gyms or dining areas before commuting to the office.

The fluctuations brought on by a pandemic, work-from-home, new COVID variants, and other factors suggest that how people travel to the mall on weekdays is still in flux, and could change further, as retailers try to reorient themselves for this post-pandemic visitor.

How Thanksgiving Weekend & Black Friday Mall Visitation Patterns Are Changing

Thanksgiving weekend, and especially Black Friday, are traditionally some of the biggest shopping days of the year, notorious for huge lines of traffic at the mall and big box stores, as people get a jump on the holidays. But the rise of e-commerce has dramatically changed in-store behavior, while working from home has made mall visits outside of typical “non-working hours” more common, as discussed above.

These behavioral changes are likely impacting the distribution of mall visits during Thanksgiving weekend.

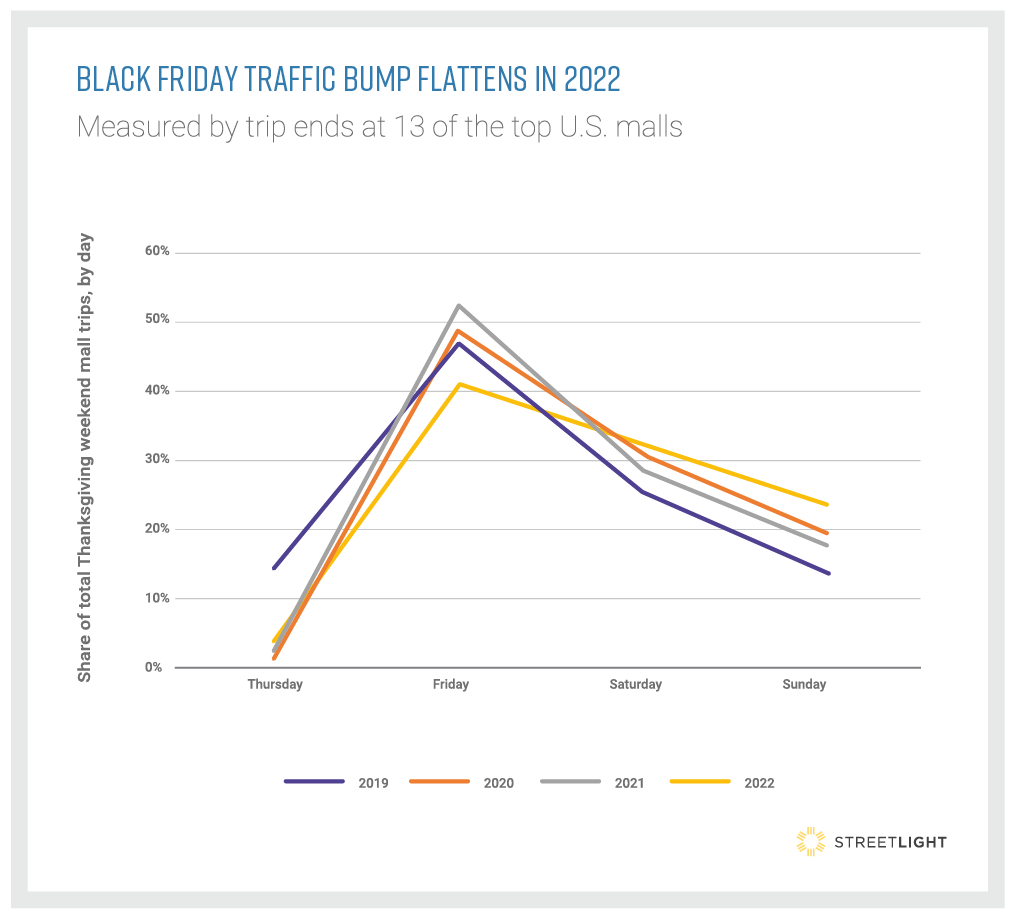

Looking at mall visits over the course of Thanksgiving weekend, it’s clear that in 2022 the hold Black Friday has over mall traffic had diminished. Black Friday still sees a plurality share of mall visits during the weekend, but it’s a much smoother line than in years past.

Another trend that jumps out is the seeming end to the Thanksgiving-day mall visit. In 2019, about 15% of mall traffic at the top 13 U.S. malls studied occurred on that holiday, but in the subsequent years it was closer to zero.

Another factor impacting mall visits is what people actually go there to do. Malls are no longer simply shopping destinations. Many have reinvented themselves for entertainment and other uses and this again has changed the nature of when people visit.

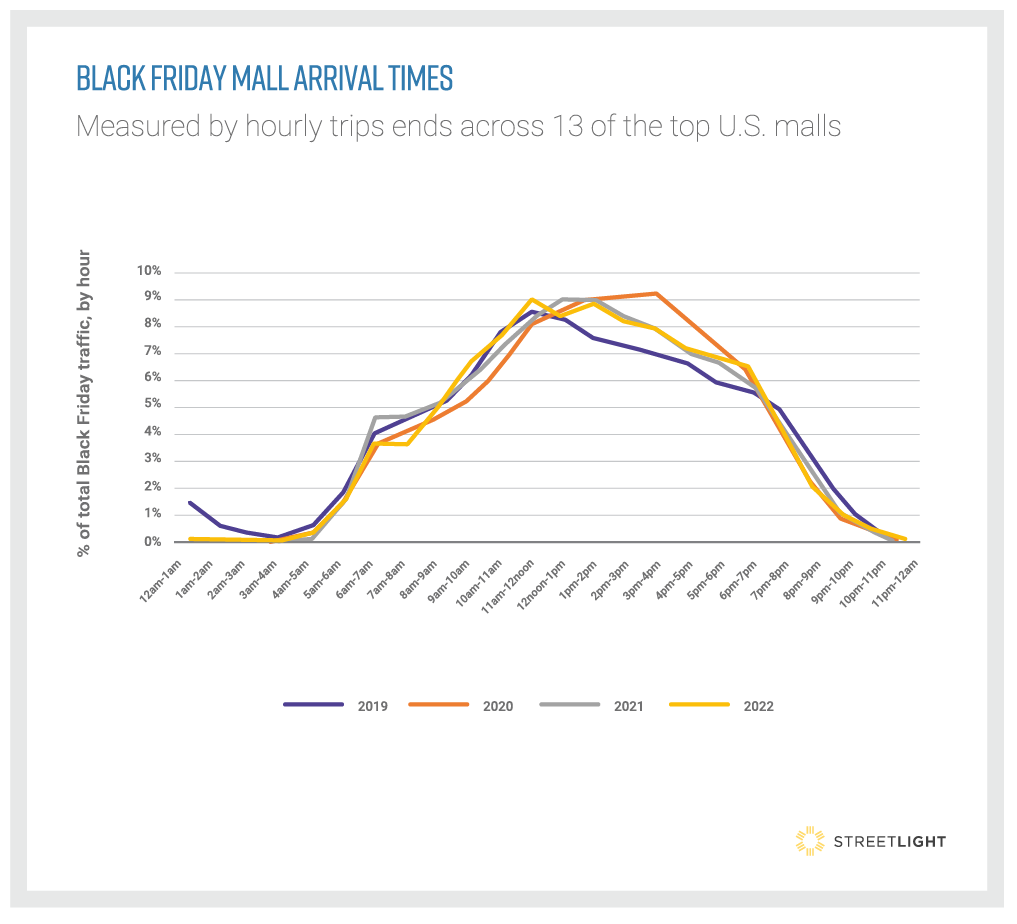

When people arrive at the mall on Black Friday does not seem to have shifted as much as the days when they visit. Looking at arrival times on the biggest shopping day of the year, we once again observe a smoothing out of visits, compared to the spikiness of prior years. The peak arrival time in 2022 was around 11am, but arrivals remain high as late as 6pm.

Lessons for Owners and Retailers: Adapting to New Visitation Behaviors

Staying up to date on these shifting mall traffic trends can help retailers and mall operators keep up with changing customer behaviors — and even take advantage of them. From staffing stores to exploring new revenue opportunities like EV charging or coworking, access to the latest traffic data can power smart decisions amid a changing retail landscape.

For example, shifting arrival patterns shed light on how new workforce behaviors are changing the wants and needs of mallgoers. With most visitors arriving earlier in the day on average and primarily visiting Monday through Friday, coworking space could be a good addition, as could gyms and yoga studios, breakfast dining, and coffee shops. For those returning to the office, daycare options might even bring parents into malls as they drop off young children before going to work.

Retailers, restaurants, and other mall businesses should also be mindful of shifting peak visitation hours as they plan their open hours, workforce, or programming. For example, retailers may need to schedule more workers during the morning and midday hours than in the afternoon or evening.

For more insight into how, when, and why customers travel, learn how you can get on-demand access to StreetLight’s transportation data. Businesses use our analytics to choose store locations, site EV chargers, map customer demand, advise their clients, and more.

- Hartmans, Avery. Insider Business. “The rise and fall of the American shopping mall.” Jan 6, 2023

- Two malls were excluded from the analysis: American Dream Mall was excluded because it was not fully open for the entirety of the study period, resulting in skewed trip data. The Shops at Columbus Circle was also excluded because its location near Central Park in New York City draws considerable pedestrian and rail traffic that would not be captured in an analysis focused on vehicle traffic.

Adapt to new customer behaviors and drive sales with in-depth traffic data

Get Traffic CountsReady to dive deeper and join the conversation?

Explore the resources listed above and don’t hesitate to reach out if you have any questions. We’re committed to fostering a collaborative community of transportation professionals dedicated to building a better future for our cities and communities.