StreetLight Closes $15 Million Investment to Transform Transportation Analytics with Big Data for the Pandemic Era

SAN FRANCISCO, CA — August 6, 2020 — StreetLight Data, Inc. (“StreetLight”), the leader in Big Data analytics for mobility, today announced it has closed a Series D funding round of $15 million. Macquarie Capital and Activate Capital joined existing investors Osage University Partners and Ajax Investment Strategies. The new round brings together world leaders in infrastructure investing and clean technology innovation with the leader in Big Data analytics for mobility, as North America’s transportation industry transitions into a new era of mobility, accelerated by the COVID-19 pandemic.

Even before the pandemic, transportation had experienced profound change, driven by population growth and congestion, changing commute patterns, and the rise of “new mobility” — placing new demands on transportation agencies already balancing budget pressures. COVID-19 has exacerbated these challenges, introducing a new level of travel volatility and forcing the industry to measure and manage more complex systems, with reduced resources and much of its staff working remotely.

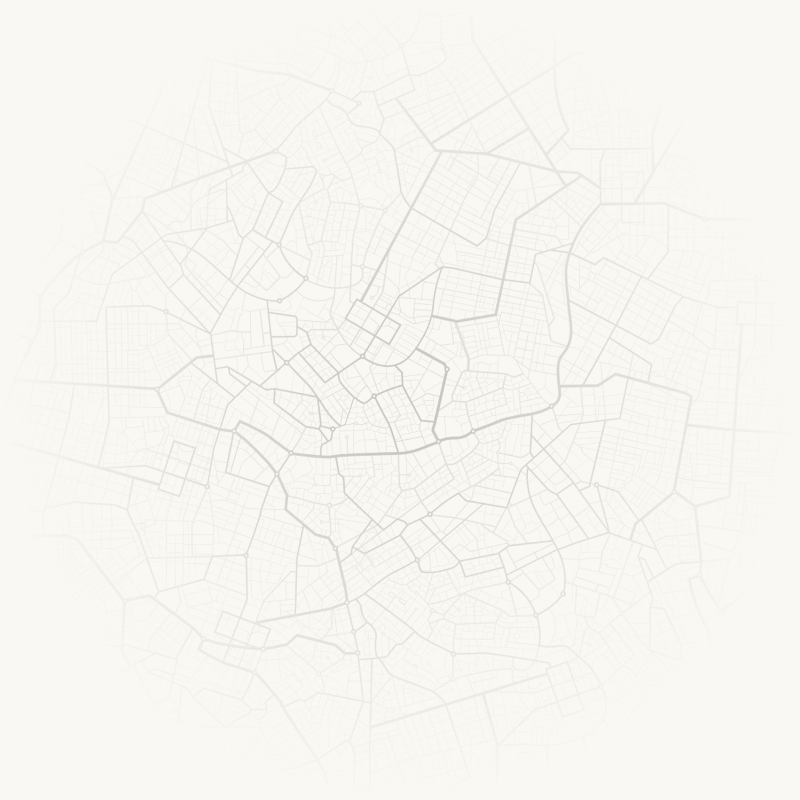

StreetLight combines machine learning with deep transportation knowledge and vast computing and mobile data resources to provide near-instant insights for virtually every road and block in North America — allowing agencies to automate and scale data collection, modernize investment decisions and lever up their efficiency, while keeping people and goods moving.

“Just as eCommerce, web conferencing and telemedicine companies have enabled life to continue in a socially distanced world, so has StreetLight enabled critical transportation planning to weather the pandemic era,”

said Laura Schewel, CEO and co-founder of StreetLight. “Governments, engineering firms and New Mobility companies need better information at a time of remote operations, increased transportation volatility and decreased budgets. The only way to do that is to replace expensive and highly manual transportation measurement approaches with on-demand metrics.”

“We are incredibly excited to partner with StreetLight as they continue through this rapid phase of growth,” said Paul Jordan, Vice President at Activate Capital, a venture firm focused on bringing digital technologies to scale across analog industries. “StreetLight brings the power of a Silicon Valley big data platform to scale for civic and commercial stakeholders, enabling them to build the connected, intelligent and sustainable transportation systems of the future.”

“What impressed us about StreetLight was its ability to innovate and build meaningful insights from a rapidly expanding base of data. We expect that those insights will have broad application and deliver significant value across multiple industries,”

said Jared Doskow, Managing Director at Macquarie Capital Principal Finance. “Macquarie Capital is excited to partner with Streetlight and leverage our deep experience in the technology and infrastructure sectors to support StreetLight’s growth.”

About StreetLight

StreetLight pioneered the use of Big Data analytics to help transportation professionals solve their biggest problems. Applying proprietary machine-learning algorithms to over four trillion spatial data points over time, StreetLight measures diverse travel patterns and makes them available on-demand via the world’s first SaaS platform for mobility, StreetLight InSight®. From identifying sources of congestion to optimizing new infrastructure to planning for autonomous vehicles, StreetLight powers more than 6,000 global projects every month. For more information, please visit: www.streetlightdata.com

About Activate Capital

Activate Capital is a leading growth equity partner to companies providing innovative solutions across the energy, transportation and industrial technology markets. With offices in San Francisco and Philadelphia, the firm partners with entrepreneurial management teams in high growth companies using technology to transform large industrial markets making the world more efficient, intelligent and sustainable. The partners have collectively invested over $1 billion across their target sectors, resulting in 30 successful exits through IPO and M&A. For more information, please visit: www.activatecp.com

About Macquarie Capital Principal Finance

Macquarie Capital Principal Finance, the principal investment business of Macquarie Capital, provides flexible primary financing and secondary market investing solutions for corporate and commercial real estate clients across North America, Europe and Australasia. The business has executed more than $36 billion of debt financing and equity investments over more than 620 deals globally since 2009. Macquarie Capital is the advisory, capital markets and principal investment arm of Macquarie Group. For more information, please visit: www.macquarie.com/us/corporate/financing/principal-finance.

About OUP (Osage University Partners)

OUP is a venture capital firm focused on investing in startups that are commercializing pioneering university technologies. OUP partners with top research universities to invest in their most innovative startups, and OUP shares its investment profit with its partner institutions. The firm invests in software, hardware, and life science companies at all stages of company development. OUP has partnered with over 100 universities, including 42 of the top 50 U.S. institutions by research expenditures, and has invested in over 100 of their spinouts. OUP is part of a family of investment funds within Osage Partners, which is based in Philadelphia, PA and manages in excess of $800 million.For more information, please visit: oup.vc

About Ajax

Ajax Strategies invests in next generation technologies to solve climate change. For more information, please visit: www.ajaxinvestmentstrategies.com“Just as eCommerce, web conferencing and telemedicine companies have enabled life to continue in a socially distanced world, so has StreetLight enabled critical transportation planning to weather the pandemic era,” said Laura Schewel, CEO and co-founder of StreetLight. “Governments, engineering firms and New Mobility companies need better information at a time of remote operations, increased transportation volatility and decreased budgets. The only way to do that is to replace expensive and highly manual transportation measurement approaches with on-demand metrics.”

“We are incredibly excited to partner with StreetLight as they continue through this rapid phase of growth,” said Paul Jordan, Vice President at Activate Capital, a venture firm focused on bringing digital technologies to scale across analog industries. “StreetLight brings the power of a Silicon Valley big data platform to scale for civic and commercial stakeholders, enabling them to build the connected, intelligent and sustainable transportation systems of the future.”

“What impressed us about StreetLight was its ability to innovate and build meaningful insights from a rapidly expanding base of data. We expect that those insights will have broad application and deliver significant value across multiple industries,” said Jared Doskow, Managing Director at Macquarie Capital Principal Finance. “Macquarie Capital is excited to partner with Streetlight and leverage our deep experience in the technology and infrastructure sectors to support StreetLight’s growth.”

About StreetLight

StreetLight pioneered the use of Big Data analytics to help transportation professionals solve their biggest problems. Applying proprietary machine-learning algorithms to over four trillion spatial data points over time, StreetLight measures diverse travel patterns and makes them available on-demand via the world’s first SaaS platform for mobility, StreetLight InSight®. From identifying sources of congestion to optimizing new infrastructure to planning for autonomous vehicles, StreetLight powers more than 6,000 global projects every month. For more information, please visit: www.streetlightdata.com

About Activate Capital

Activate Capital is a leading growth equity partner to companies providing innovative solutions across the energy, transportation and industrial technology markets. With offices in San Francisco and Philadelphia, the firm partners with entrepreneurial management teams in high growth companies using technology to transform large industrial markets making the world more efficient, intelligent and sustainable. The partners have collectively invested over $1 billion across their target sectors, resulting in 30 successful exits through IPO and M&A. For more information, please visit: www.activatecp.com

About Macquarie Capital Principal Finance

Macquarie Capital Principal Finance, the principal investment business of Macquarie Capital, provides flexible primary financing and secondary market investing solutions for corporate and commercial real estate clients across North America, Europe and Australasia. The business has executed more than $36 billion of debt financing and equity investments over more than 620 deals globally since 2009. Macquarie Capital is the advisory, capital markets and principal investment arm of Macquarie Group. For more information, please visit: www.macquarie.com/us/corporate/financing/principal-finance.

About OUP (Osage University Partners)

OUP is a venture capital firm focused on investing in startups that are commercializing pioneering university technologies. OUP partners with top research universities to invest in their most innovative startups, and OUP shares its investment profit with its partner institutions. The firm invests in software, hardware, and life science companies at all stages of company development. OUP has partnered with over 100 universities, including 42 of the top 50 U.S. institutions by research expenditures, and has invested in over 100 of their spinouts. OUP is part of a family of investment funds within Osage Partners, which is based in Philadelphia, PA and manages in excess of $800 million.For more information, please visit: oup.vc

About Ajax

Ajax Strategies invests in next generation technologies to solve climate change. For more information, please visit: www.ajaxinvestmentstrategies.com